Exploring Fertilizer Stocks Under Rs. 100: Opportunities and Challenges

Introduction

Fertilizer stocks represent shares of companies involved in the production and distribution of substances designed to improve soil fertility and enhance plant growth. These companies play a pivotal role in supporting global agriculture and food production, making them critical to sustaining a growing global population. For investors, these stocks offer an opportunity to engage with the agricultural sector, which is influenced by factors such as global food demand, commodity prices, and technological advancements in farming.

Among fertilizer stocks, those priced under Rs. 100 attracts significant attention due to its affordability and growth potential. These stocks can serve as entry points for investors looking to benefit from the agriculture industry’s long-term prospects while minimizing initial capital outlays. However, like all investments, they come with a set of risks and considerations that investors should thoroughly evaluate.

Understanding Fertilizer Stocks Priced Below Rs. 100

Fertilizer stocks priced under Rs. 100 represents a niche in the stock market where affordability meets growth potential. These stocks are typically from smaller or mid-sized companies operating in the fertilizer sector, which serves as a backbone for global agriculture.

Examples of notable fertilizer stocks in this category include companies like Kothari Industrial Corp Ltd, Welterman International Ltd, and MP Agro Industries Ltd. These companies have exhibited remarkable growth over the past year, with returns as high as 166.67% in some cases. Despite their impressive performance, investors must exercise caution, as such growth often comes with heightened volatility and associated risks.

Top Fertilizer Stocks Under Rs. 100

Here’s a list of some of the best-performing fertilizer stocks priced below Rs. 100, ranked based on their 1-year return:

|

Company Name |

1-Year Return (%) |

Closing Price (Rs. ) |

|

166.67% |

Rs. 5.04 |

|

|

93.15% |

Rs. 22.83 |

|

|

61.70% |

Rs. 11.40 |

|

|

44% |

Rs. 3.63 |

|

|

30.54% |

Rs. 69.25 |

These stocks demonstrate significant growth potential, making them worth considering for investors seeking affordable entry points into the fertilizer industry. However, thorough research and risk assessment are essential before investing.

Overview of Top Fertilizer Stocks Under Rs. 100

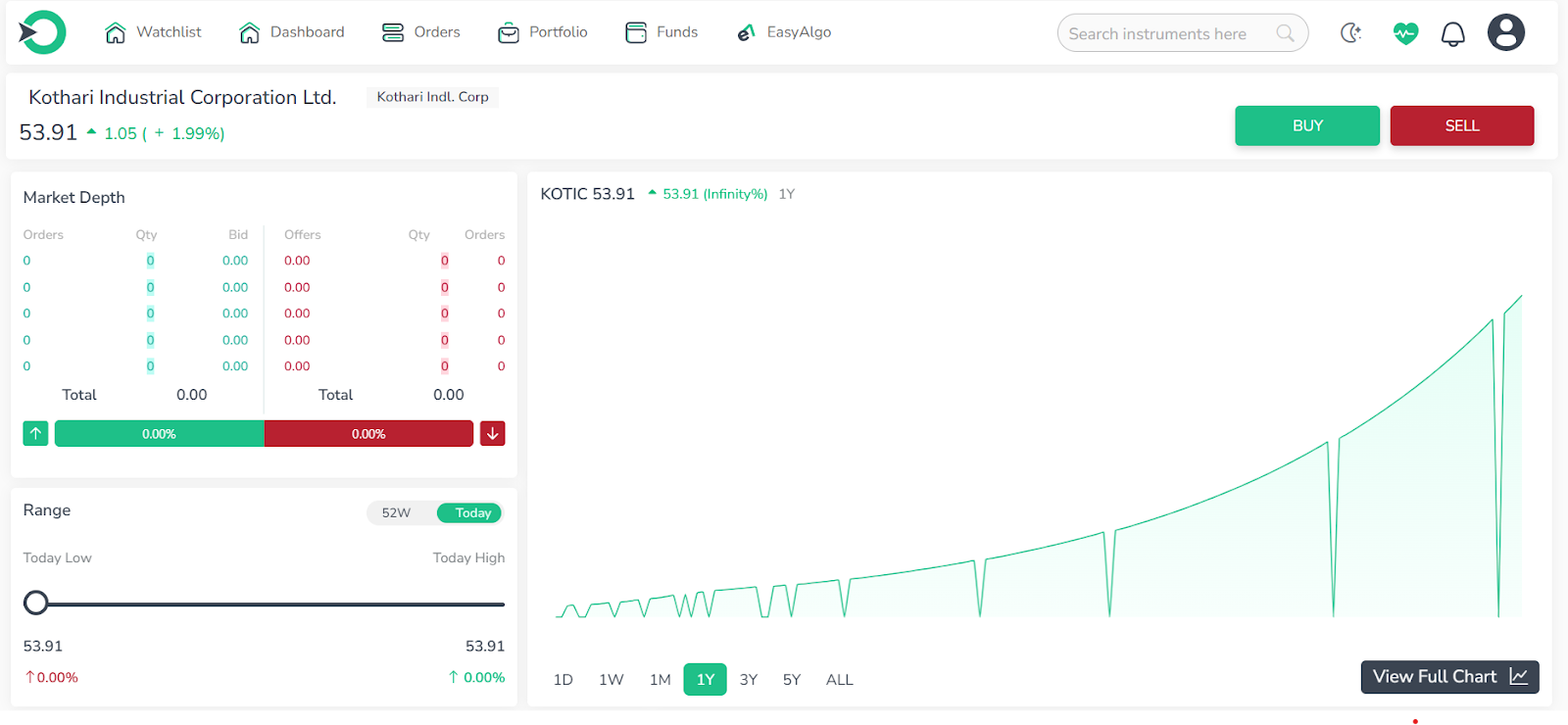

1. Kothari Industrial Corp Ltd

Kothari Industrial Corporation Ltd. (KICL) focuses on the production and blending of fertilizers, catering to a strong distributor network across southern India. Over time, the company has established a reputable brand presence in the marketplace. Additionally, KICL operates as a diversified enterprise with four core divisions: Textiles, Plantations, Granite, and Fertilizers.

Kothari Industrial Corporation Ltd. has successfully reduced its debt by Rs. 39.35 crore while maintaining an impressive ROCE of 91.55% over the past three years. Its PEG ratio stands at an attractive 0.02, supported by an efficient cash conversion cycle of 46.82 days. Additionally, a high promoter holding of 53.38% reflects strong insider confidence.

However, the company faces significant challenges. It has reported poor revenue growth of just 4.69% over the past three years and a weak ROE of 0% during the same period. Contingent liabilities amount to Rs. 22.63 crore, and it struggles with negative cash flow from operations at -Rs. 35.07 crore. Furthermore, its EBITDA margin remains low at -55.38% over the past five years

2. Welterman International Ltd

Founded in 1992, Welterman International Ltd operates in the leather and fertilizer industries.

Welterman International Ltd. demonstrates operational efficiency with a cash conversion cycle of 0 days and a robust average operating leverage of 9.43. However, the company faces challenges, including poor profit growth of 8.22% and a significant revenue decline of -100% over the past three years. Additionally, its return on equity (ROE) and return on capital employed (ROCE) have remained stagnant at 0% during the same period.

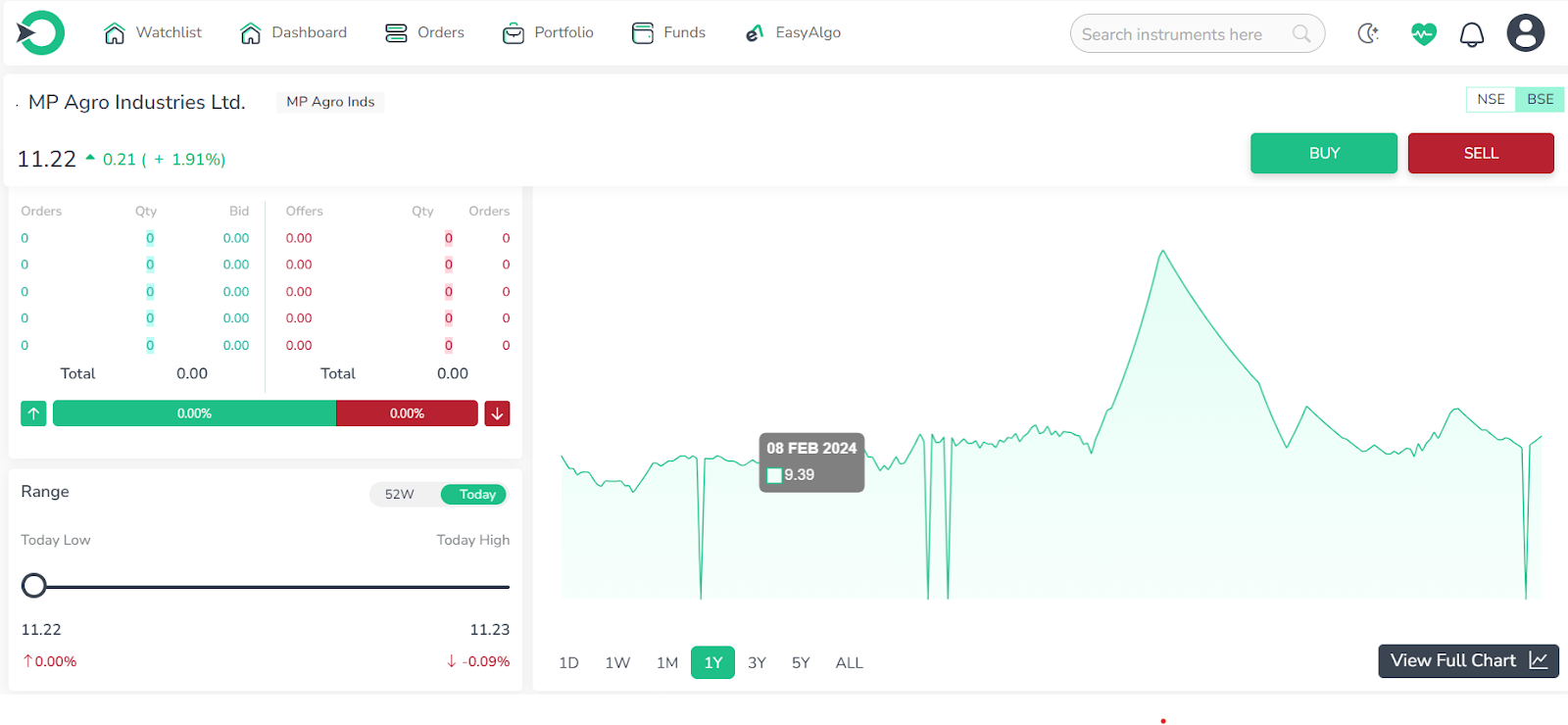

3. MP Agro Industries Ltd

MP Agro Industries Ltd. specializes in the production, storage, packaging, distribution, and transportation of chemical fertilizers and industrial chemicals.

MP Agro Industries Ltd. stands out for being virtually debt-free and maintaining a strong liquidity position, reflected in its current ratio of 24.16. The company also boasts an efficient cash conversion cycle of -81.86 days and a PEG ratio of 0.87. However, it faces challenges such as poor revenue growth of -11.19% over the past three years and subpar returns, with an ROE of 0.54% and ROCE of 0.70% during the same period. Additionally, it struggles with negative cash flow from operations at -0.39 and a low EBITDA margin of -33.59% over the past five years.

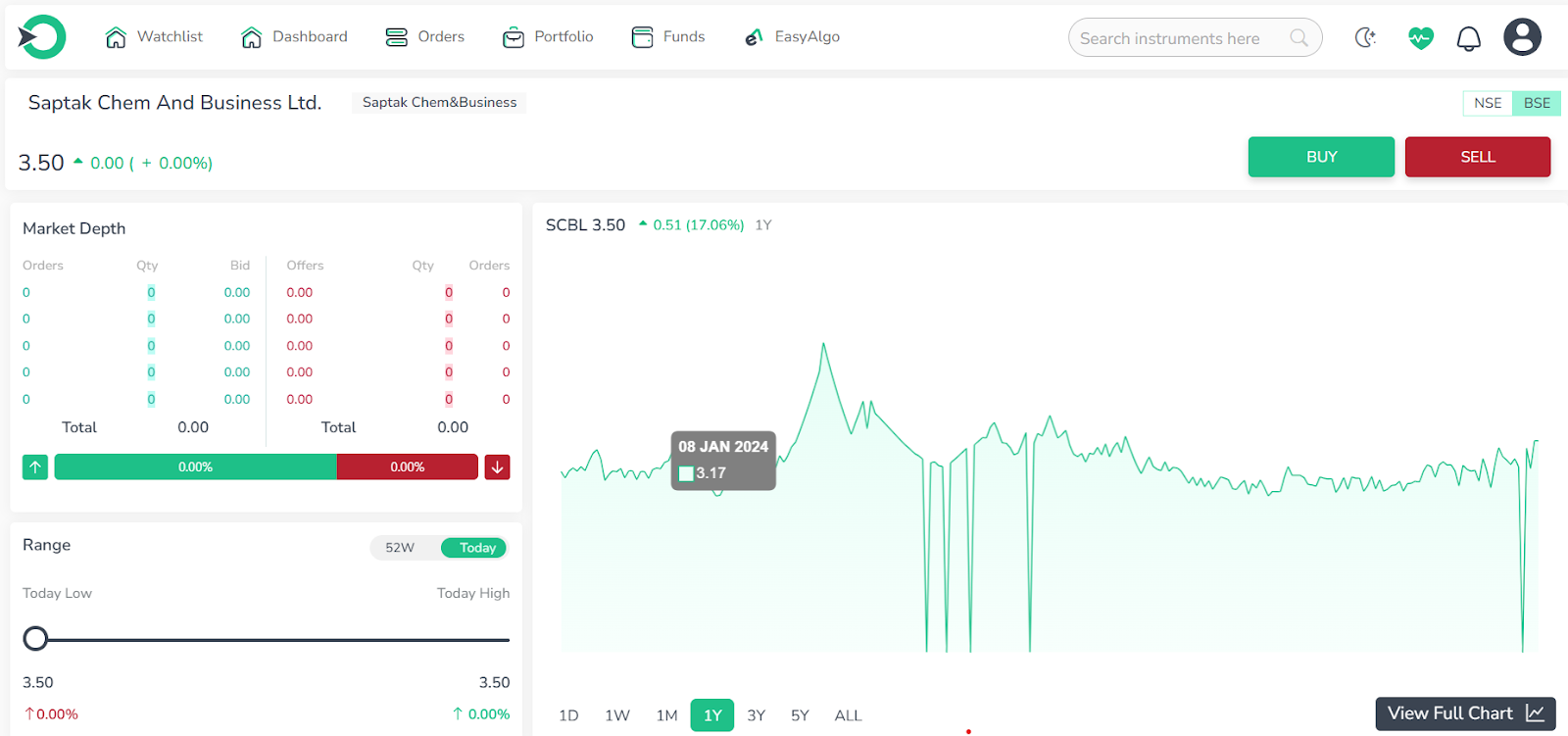

4. Saptak Chem and Business Ltd

Saptak Chem and Business Ltd operates as a chemical enterprise specializing in the production, import, export, and trading of chemicals and agricultural products.

The company demonstrates an efficient Cash Conversion Cycle of 0 days. However, it has faced challenges, including a decline in profit growth of -33.12% over the past 3 years and a complete lack of revenue growth during the same period. The company also struggles with a low ROE of 0% and a negative ROCE of -2.18% over the past 3 years.

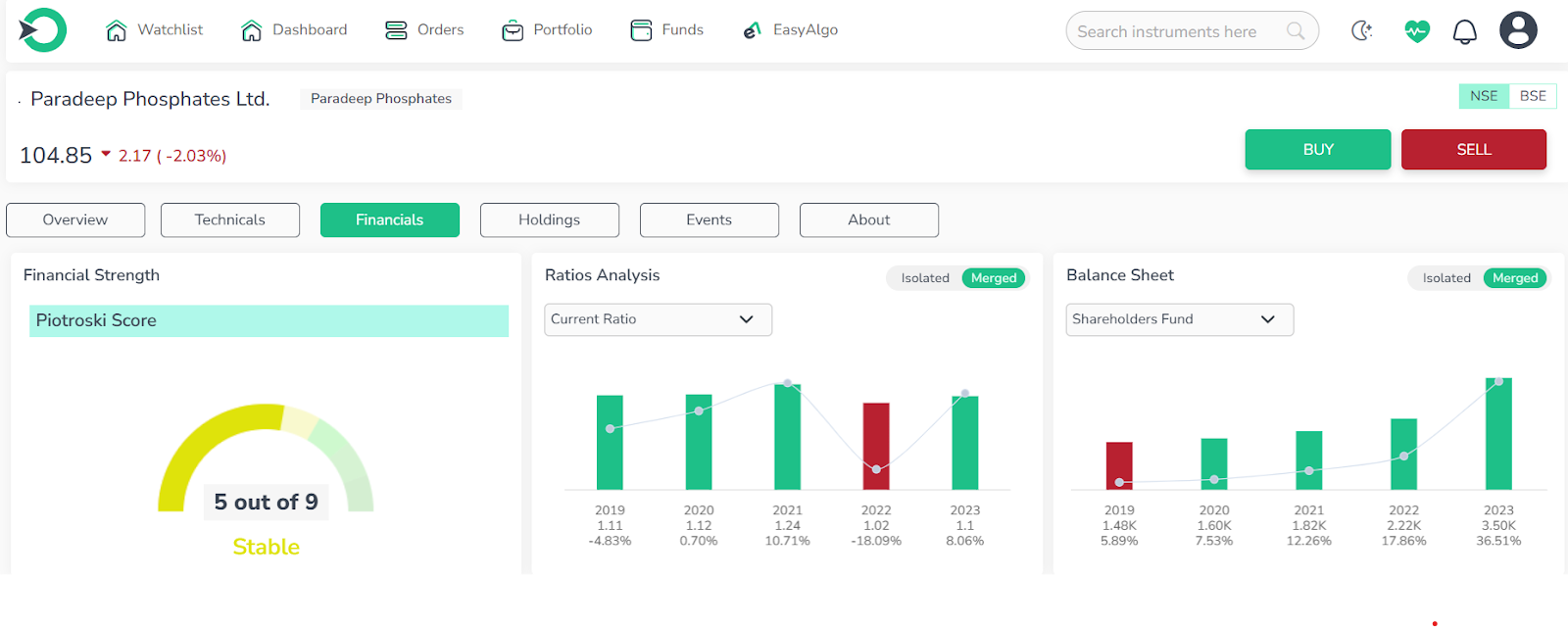

5. Paradeep Phosphates Ltd

Paradeep Phosphates Limited (PPL) is a prominent Indian company involved in the production and distribution of fertilizers, along with a range of other industrial products.

The company has demonstrated a solid revenue growth of 30.87% over the past three years and has effective cash flow management, with a CFO/PAT ratio of 1.47. It also boasts a strong promoter holding of 56.08%. However, it has faced a decline in profit growth, showing a negative growth of -23.70% over the same period. Additionally, the company is currently trading at a relatively high price-to-earnings ratio of 23.58.

Comparison of the Top three Fertilizer Stocks Under Rs. 100

Comparison of Key Financial Metrics for Kothari Industrial Corp Ltd, Saptak Chem and Business Ltd, and Paradeep Phosphates Ltd

|

Company |

Revenue Growth (5 years) |

Market Share Growth (5 years) |

Net Income Growth (5 years) |

Debt to Equity Ratio (5 years) |

Current Ratio (5 years) |

|

Kothari Industrial Corp Ltd |

28.32% |

0.02% to 0.04% |

121.08% |

101.90% |

44.13% |

|

Saptak Chem and Business Ltd |

N/A |

N/A |

N/A |

-127.46% |

17.83% |

|

Paradeep Phosphates Ltd |

21.50% |

3.39% to 5.44% |

-8.87% |

117.95% |

111.51% |

|

Industry Average |

10% |

N/A |

-4.08% |

68.64% |

138.89% |

Who Should Consider Investing in Fertilizer Stocks Under Rs. 100?

Fertilizer stocks priced below Rs. 100 can appeal to a specific segment of investors. They are particularly suited for individuals with a keen interest in agriculture and commodities, who believe in the long-term growth potential driven by global food demand. These stocks are an excellent choice for risk-tolerant investors who are willing to navigate market fluctuations for potentially higher returns.

However, such investments are not for everyone. Conservative investors or those seeking stable, low-risk opportunities might find these stocks less appealing due to their inherent volatility. Those considering fertilizer stocks should also be prepared to monitor industry trends, company performance, and regulatory changes closely to make informed decisions.

Evaluating the Performance of Fertilizer Stocks

Investors must consider several key metrics to assess the performance of fertilizer stocks. Revenue growth and profit margins are essential indicators of a company’s financial health, reflecting its ability to generate consistent sales and manage costs effectively. Additionally, examining a company’s debt levels and earnings trends can offer insights into its financial stability and growth potential.

External factors such as global commodity prices, agricultural policies, and currency fluctuations also play a significant role in shaping the performance of fertilizer stocks. For instance, rising raw material costs or adverse regulatory changes can impact profitability. Understanding these metrics allows investors to make informed decisions and minimize risks.

Benefits of Investing in Fertilizer Stocks Under Rs. 100

Investing in fertilizer stocks below Rs. 100 offers several advantages, making them an attractive option for a wide range of investors. These benefits include:

-

Affordability: These stocks provide an accessible entry point, enabling investors to diversify their portfolios without requiring significant capital.

-

Sector Necessity: The fertilizer industry’s critical role in global agriculture ensures steady demand, bolstered further by the world’s growing population.

-

Volatility Advantage: While lower-priced stocks often exhibit higher volatility, strategic investors can capitalize on price swings to maximize returns.

-

Emerging Market Growth: Many fertilizer companies operate in emerging markets, which are experiencing rapid agricultural modernization and expansion. This growth opportunity has the potential to deliver significant returns for investors.

Challenges Associated with Fertilizer Stocks

While fertilizer stocks offer promising opportunities, they also come with inherent challenges that investors must navigate.

One of the primary risks is market volatility, which can result in significant price fluctuations, particularly in lower-priced stocks. For investors who prioritize stability, this volatility may prove daunting. Additionally, the fertilizer industry faces stringent regulatory scrutiny, with changes in policies potentially affecting operations and profitability.

Another critical challenge is the dependency on commodity prices. Variations in the cost of raw materials like phosphates and natural gas can directly impact a company’s earnings. Some companies may also lack the financial resources to invest in technology or expansion, limiting their growth potential in a competitive market.

Conclusion

Fertilizer stocks priced under Rs. 100 represent a unique blend of affordability and growth potential within the agricultural sector. These stocks offer an opportunity to participate in a vital industry essential to global food production, making them attractive to investors with a keen interest in agriculture and commodities.

However, investing in this niche demands thorough research, an understanding of market dynamics, and a willingness to navigate challenges such as volatility and regulatory risks. By carefully evaluating performance metrics, diversifying portfolios, and staying attuned to industry trends, investors can make informed decisions to maximize returns while mitigating risks.

As the global demand for food continues to rise, the fertilizer industry’s relevance remains strong, positioning it as an intriguing investment avenue for those seeking long-term growth.

To make the most of opportunities in fertilizer stocks and other promising sectors, consider using Enrich Money’s user-friendly trading platform, designed to help you make informed investment decisions with ease and confidence.

Frequently Asked Questions

-

What are fertilizer stocks priced under Rs. 100?

Fertilizer stocks priced under Rs. 100 represent shares of smaller or mid-sized companies in the fertilizer sector that are more affordable for investors. These companies play a vital role in agriculture and food production.

-

What are the advantages of investing in fertilizer stocks under Rs. 100?

These stocks offer affordability, allowing investors to diversify without significant capital. They also present opportunities for growth, driven by global food demand and the necessity of fertilizers in agriculture.

-

Are there risks involved in investing in fertilizer stocks under Rs. 100?

Yes, there are risks, including market volatility and dependency on fluctuating commodity prices. Additionally, changes in regulatory policies can impact profitability, and smaller companies may face financial challenges.

-

How do I evaluate the performance of fertilizer stocks?

To assess performance, investors should look at key metrics such as revenue growth, profit margins, debt levels, and cash flow. External factors like commodity prices and agricultural policies are also important to consider.

-

Who should invest in fertilizer stocks under Rs. 100?

Fertilizer stocks under Rs. 100 are best suited for risk-tolerant investors with an interest in agriculture and long-term growth potential. Conservative investors seeking stable returns may find these stocks too volatile.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.